You will have enough money for a pleasant retirement if your investments increase sufficiently. Now is the time to begin, even though that feels far off. Furthermore, you don’t need to be an expert investor to profit.

This is due to the fact that accumulating a nest egg isn’t solely dependent on discovering a hidden investment gem or purchasing and disposing of numerous ones.

The easy trick? Make use of compound interest and long-term investing. A passive strategy is quite adequate.

A dollar that is saved grows in value

Compound interest can be thought of as the earning potential of your money on steroids. Assume that on January 1, 2000, you had $100 in a savings account at a credit union or bank, and that you continued to add $100 every month until the end of 2023.

With an average interest rate of, say, 5%, it would make your total contribution $28,800. In reality, though, you would have more like $54,937. (Keep in mind that a savings account yielding 5% would be extremely favorable.)

Compound interest and letting the money grow on its own are beautiful things. Interest is accrued on an increasing sum. Stock market investing has the potential to be considerably more profitable.

Although a rising market is not guaranteed, investing using a tried-and-true passive strategy, $100 a month since the year 2000, would now amount to $77,869 based on the S&P 500 index’s average annual total return of 7.5%, a crucial benchmark made up of the 500 largest publicly traded companies in America.

Read Also: Are You Saving More in Your 401(k) Without Knowing It? Here’s Why

Increase your passive investments actively

For individuals who would prefer not to actively watch and manage their stocks, passive investments are a great method to set it and forget it. One popular example of such an investment is the widely held Vanguard S&P 500 ETF.

ETFs are low-effort and low-knowledge investments that let you diversify your portfolio over many firms and reduce the danger of owning individual stocks while still taking advantage of the market’s overall growth (albeit this growth is not assured).

The market does indeed have downswings, which might be problematic if you don’t have enough time to weather these before you need your money.

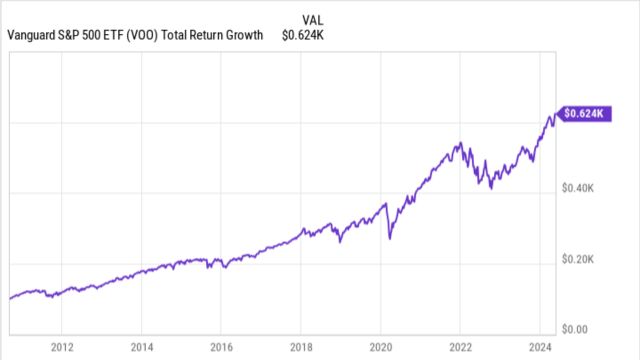

The above graph illustrates how, as the new century arrived, $100 invested in the Vanguard ETF would be worth more than $600. Using a 7.5% average return, another $100 per month after that results in the roughly $78,000 that was previously mentioned. That’s the power of investing consistently in your future, as well as compounding.

Read Also: Big Paycheck, Big Commute: The $250K Trade-Off

Increase your chances of retiring significantly

The ability to earn returns on your returns is what gives compounding its power, enabling your money to expand exponentially over time. Small investments can grow into a sizable nest egg if made consistently and at an early age.

When it comes time for you to retire, every dollar you save now might grow – well, tremendously. It isn’t actually a ruse. It really is that easy.

Leave a Reply