NEW YORK – On Monday at a court in New York, the fraud case that is being brought against the founder of a student loan aid startup company that J.P. Morgan Chase acquired for $175 million two years ago went a step closer to being tried. The founder entered a plea of not guilty and was indicted in the case.

The guilty plea was made on behalf of Charlie Javice, 31, by her attorney in response to an indictment that was returned late last week in federal court in Manhattan charging her with conspiracy as well as wire fraud and bank fraud.

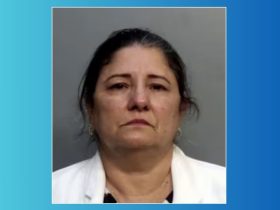

The citizen of Miami Beach who was responsible for founding Frank appeared in a remote proceeding before U.S. Magistrate Judge Gabriel Gorenstein. Her face, along with the faces of defense lawyers and prosecutors, was projected onto a video screen during the proceeding.

According to him, her subsequent court appearance would take place on June 6 in front of a judge who would preside over a trial.

Javice is accused of deceiving JPMC into purchasing her company by creating statistics that made it appear as though Frank had more than 4.25 million consumers. In reality, Frank had less than 300,000 clients. Javice is currently free on bond in the amount of $2 million.

When she was arrested at the beginning of April, the authorities stated that she would have made $45 million from her fraudulent activities.

At the beginning of May, the prosecutors filed a letter saying that the government requested extra thirty days to “engage in further discussions with counsel about the disposition of this case.” As a result, the deadline to bring an indictment against Javice was postponed.

The indictment was a sign that the case was now on the road to trial for a woman who had appeared on the Forbes 2019 “30 Under 30” list of young professionals whose impactful careers seemed to be on an upward trajectory worthy of admiration.

Despite the fact that negotiations of this kind can sometimes result in deals, the indictment was a signal that the case was now on the road to trial.

When her attorney, Alex Spiro, claimed that prosecutors have not turned over any evidence in the case, he may have been reflecting the contentious environment that was created by the breakdown of talks and the coming of the indictment at the end of the previous week.

He stated, “We’ve gotten nothing,” and I agreed with him.

Dina McLeod, an assistant United States attorney, remarked that the indictment was relatively new.

She stated, “This is a complex case,” and went on to say that the enormous amount of papers that would be turned over to the defense prior to the trial need to be evaluated by prosecutors before the defense can access them.

The indictment, for the most part, was identical to a criminal complaint that was made public at the time that Javice was detained.

In addition to the individual counts of wire fraud, bank fraud, and securities fraud, she was also charged with one count of conspiracy to commit wire fraud and bank fraud.

According to the authorities, in 2017, Javice founded TAPD Inc., which operated under the name Frank, with the intention of providing an online platform to simplify the process of filling out the Free Application for Federal Student Aid, a form used by students to apply for financial aid for college or graduate school that is administered by the federal government.

Read More About the Latest Crime News in Florida:

Leave a Reply