WPBN: According to the most recent information provided by the Florida Office of Insurance Regulation (FLOIR), more over half of all house insurance claims that were filed in connection with Hurricanes Helene and Milton have been closed without payment.

Why It Is Important?

During the month of September, Hurricane Helene wreaked havoc over a number of states in the United States, resulting in the deaths of over two hundred individuals and causing extensive damage to both residential and commercial properties.

Just two weeks later, at the beginning of October, Hurricane Milton caused additional havoc to the state of Florida and was responsible for the deaths of more than a dozen individuals.

A difficult pill to chew for Floridians, who already pay some of the highest house insurance premiums in the United States, is the fact that thousands of homes were destroyed during both hurricanes. Those homeowners who filed insurance claims that were denied will be responsible for paying for the repairs themselves.

The average annual premium for homeowner’s insurance for a home with a value of $300,000 in December 2024 is $5,527, as reported by Bankrate.

This is more than twice as much as the typical premium in adjacent states like as Georgia ($2,071) and Alabama ($2,745). When compared to the national average of $2,285, the average premium for homeowner’s insurance in Florida is $3,242 higher than the national average.

What You Should Be Aware Of?

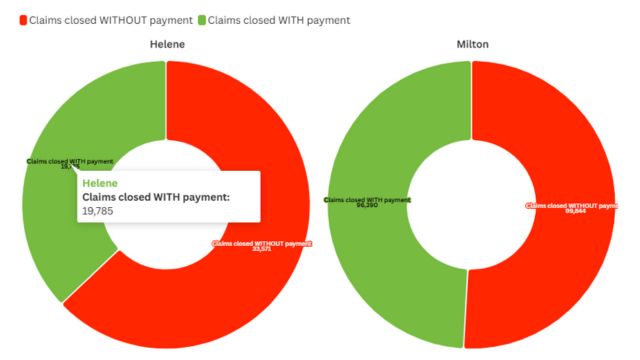

There have been 53,356 residential claims for damage caused by Hurricane Helene that have been processed, according to the most recent data that was given by FLOIR on December 16 2017. 33,571 of the cases resulted in no payment, while 19,785 of those cases were resolved with a payment, which accounts for 39.4 percent of the total.

Falling Drone Hits Boy at Florida Holiday Event, Leading to Serious Injuries

There is a greater possibility that your claim for damage caused by Hurricane Milton has been successful in being paid out. As of the 18th of December, out of the 196,234 claims that had been finished, 99,844 (which are equivalent to 50.8%) were closed without payment, while 96,390 (which are equivalent to 49.2%) were handled with payment.

According to FLOIR, the most common reasons for a claim to be closed without payment are either the fact that the deductible has not been met or the fact that the claim is for flood damage, which is typically not covered by a homeowner’s insurance policy.

Additional reasons include the customer withdrawing the claim or the insured party “not being reachable to adjudicate the claim.” Both of these scenarios are very common.

Missouri Highway Patrol Pushes for Full Compliance with Hands-Free Driving Law

Insurance Claims of Hurricanes Helene and Milton

What Comes After This?

It is quite doubtful that the precise number and percentages of all claims that have been made in relation to Helene and Milton will be published in the near future. This is due to the fact that every case is unique, and the resolution of some instances can take significantly more time than the resolution of others.

Important Social Security Change for 2025, What All Workers Need to Prepare For?

There are certain claims that have not been finished, according on the FLOIR datasets that were collected from two more major hurricanes that struck Florida: Idalia in August 2023 and Ian in September 2022.

Leave a Reply